- 01 - Histograms and scatterplots

- 03 - Quiz What would it look like

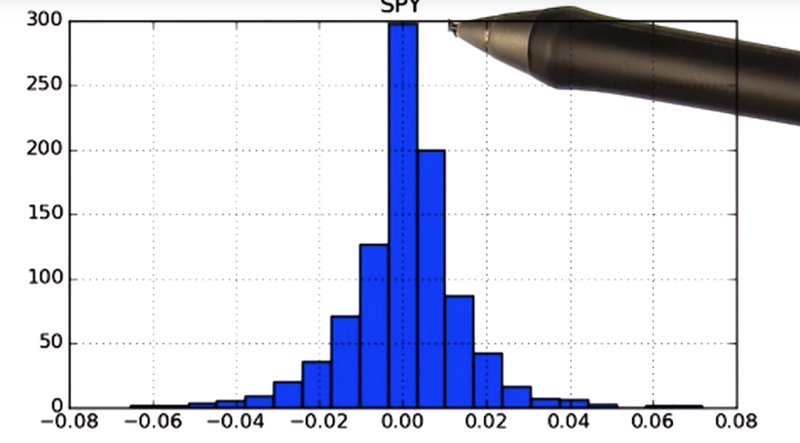

- 04 - Histogram of daily returns

- 05 - How to plot a histogram

- 06 - Computing histogram statistics

- 07 - quiz: Compare two histograms

- 8 - Plot two histograms together

- 9 - Scatterplots

- 10 - Fitting a line to data points

- 11 - Slope does not equal correlation

- 12 - Quiz: Correlation vs slope

- 13 - Scatterplots in python

- 14 - Real world use of kurtosis

01 - Histograms and scatterplots

- One of the most informative ways to consider daily returns is when we compare the returns of one stock with another.

Time: 00:00:19

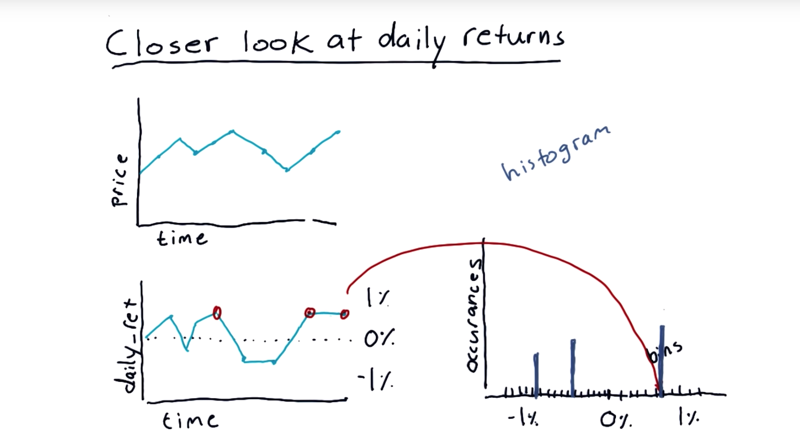

02 - A closer look at daily returns

- starting with a price time series.

- we build daily returns, this daily return data is not too revealing as time-series.

histograms

- A histogram is a kind of bar chart where we plot the number of occurrences of each item versus the value.

- split up the range of data into lots of little bins.

- and count up how many times the data matches the range across that bin.

- a bar of the appropriate height in the histogram that represents how many times the data matched that value.

Time: 00:02:12

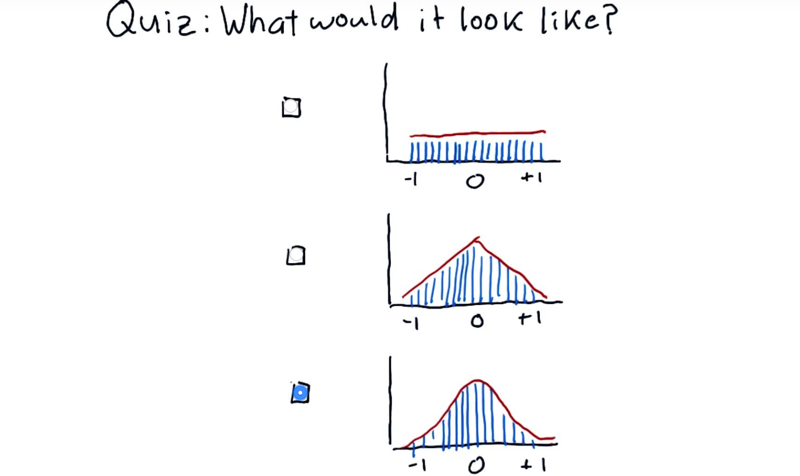

03 - Quiz What would it look like

What the histogram of S&P 500 daily return over many years look like?

The correct answer: bell curve.

Time: 00:00:16

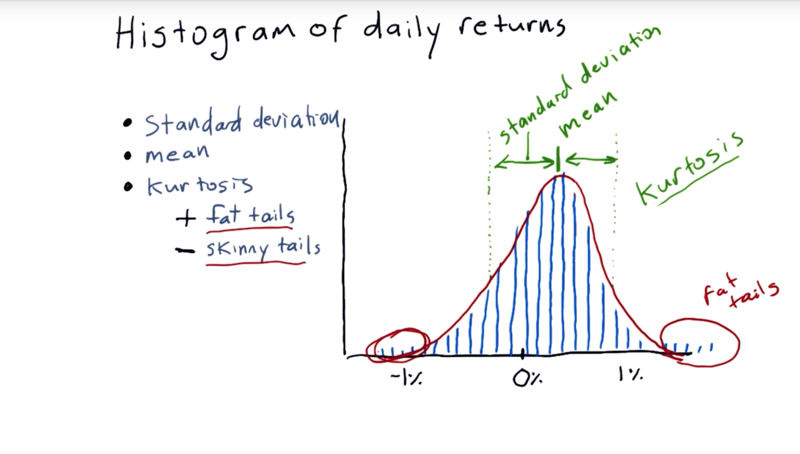

04 - Histogram of daily returns

Statistics we can run on it to characterize histograms.

- mean.

- standard deviation: how far do individual measurements deviate from the mean.

- Kurtosis (means curved or arching): it tells us about the tails of the distribution.

The measure of kurtosis tells us how much different our histogram from that traditional Gaussian distribution.

- Positive Kurtosiswe indicate fat tails, Meaning that there are more occurrences out in these tails than would be expected if it were a normal distribution.

- Negative kurtosis indicates skinnytails, meaning that there are many fewer occurrences than would be expected if it were a normal distribution on the tails.

Time: 00:02:25

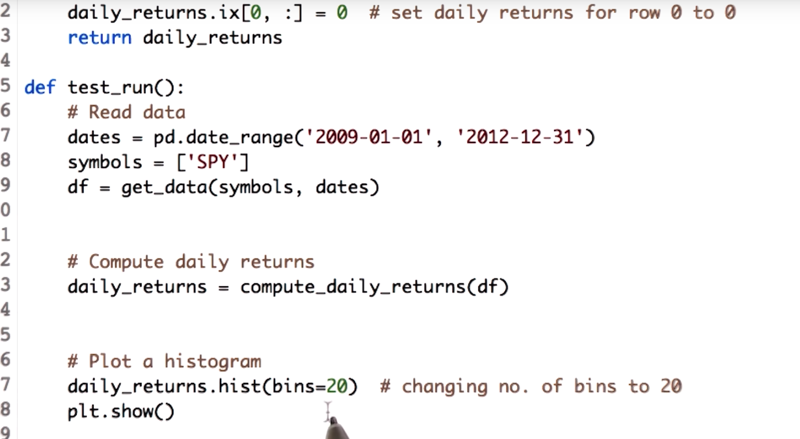

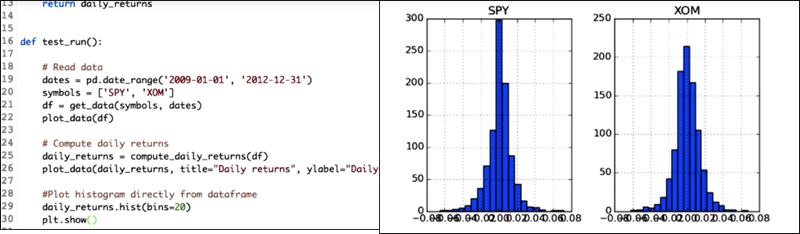

05 - How to plot a histogram

daily_returns.hist(bin=20) will plot daily_return as histogram with 20 bins. the default bin parameter is 10.

Time: 00:02:03

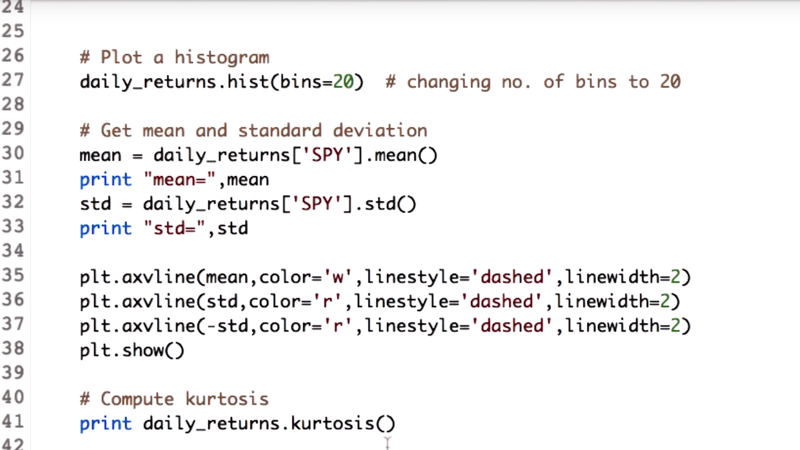

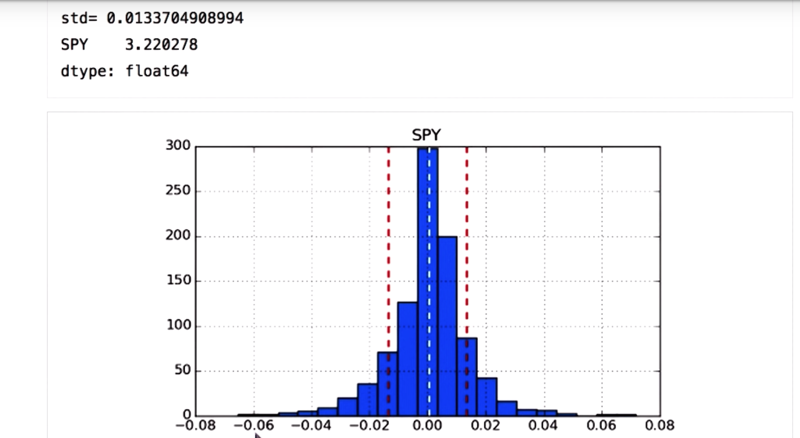

06 - Computing histogram statistics

Calculate mea and deviation and kurtosis:

Calculate mea and deviation and kurtosis:

mean = daily_returns['SPY'].mean()

std = daily_returns['SPY'].std()

kurtosis = daily_returns.kurtosis()

Plot mean and diviation using axvline() in the Matplotlib library .

plt.axvline(mean, color='w', linestyle='dashed', linewidth=2)

plt.axvline(std, color='r', linestyle='dashed', linewidth=2)

plt.axvline(-std, color='r', linestyle='dashed', linewidth=2)

plt.show()

-

positive kurtosis for the SPY stock, which means we have fat tails.

-

Note:

bincounts()usingnumpy.histogramfunction.

Time: 00:02:11

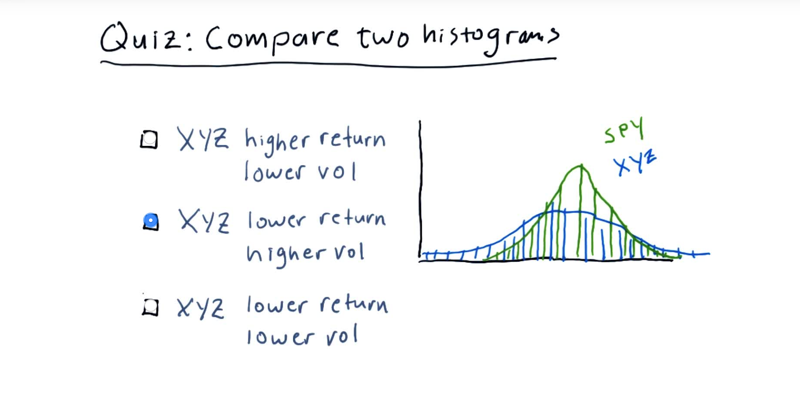

07 - quiz: Compare two histograms

Quiz: Select the option that best describes the relationship between XYZ and SPY.

Note:

- These are histograms of daily return values, i.e. X-axis is +/- change (%), and Y-axis is the number of occurrences.

- We are considering two general properties indicated by the histogram for each stock: return and volatility (or risk).

correct answer: XYZ has a lower return and higher volatility than SPY.

- mean of XYZ, is lower than the mean of SPY.

- XYZ got a larger standard deviation (broader shoulders), therefore, higher volatility.

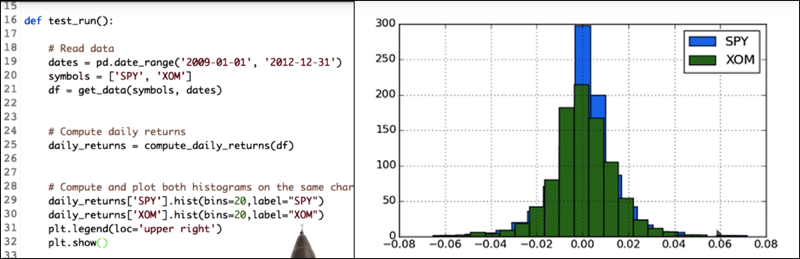

8 - Plot two histograms together

Since the daily_returns data frame has data for two stocks, daily_returns.hist(bin=20) will plot the data in two subplots.

daily_returns['SPY'].hist(bin=20,label="SPY")

daily_returns['XOM'].hist(bin=20,label="XOM")

...

- To get two histograms on the same x and y axis, call the histogram functions separately on each of the stocks daily return values.

- also add the label parameter so that we can differentiate between the histogram of the SPY and XOM.

Time: 00:01:31

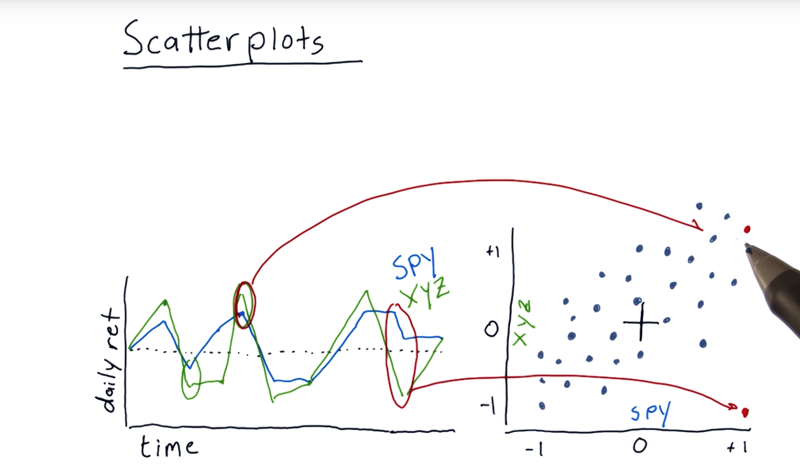

9 - Scatterplots

A scatterplot is another way to visualize the differences between daily returns of individual stocks. The left graph is daily return of two stocks. S&P 500 and XYZ.

- On a scatterplot, there are a number of individual points or dots represents the daily returns of two stocks that happened on a particular day.

- the dots are somewhat scattered. They don’t form a perfect line.

Time: 00:02:02

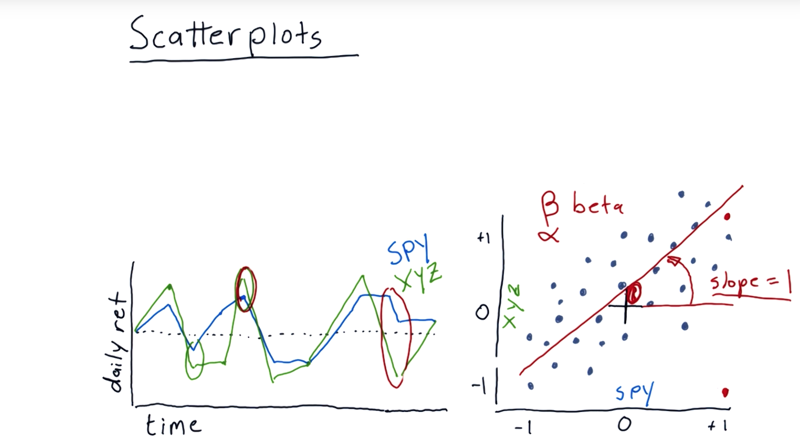

10 - Fitting a line to data points

- we can fit a line to it using linear regression.

- slope, in financial terminology, is usually referred to as beta which means is how reactive is the stock to the market.

- e.g. Beta = 1 then on average, when the market goes up 1%, that particular stock also goes up 1%.

- if beta = 2, then if the market were to go up 1%, we’d expect on average for that stock to go up 2%.

- intercepts, also called alpha. Positive alpha means that this stock is actually on average performing a little bit better than the S&P 500 every day. If it’s negative, it means on average it’s returning a little bit less than the market overall.

Time: 00:01:53

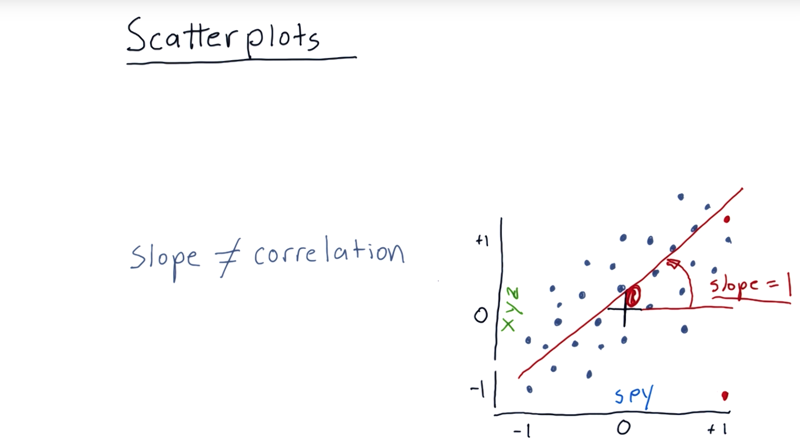

11 - Slope does not equal correlation

- The slope is no correlation.

- Correlation is a measure of how tightly do these individual points fit that line. the range of correlation is from 0 to 1.

Time: 00:01:15

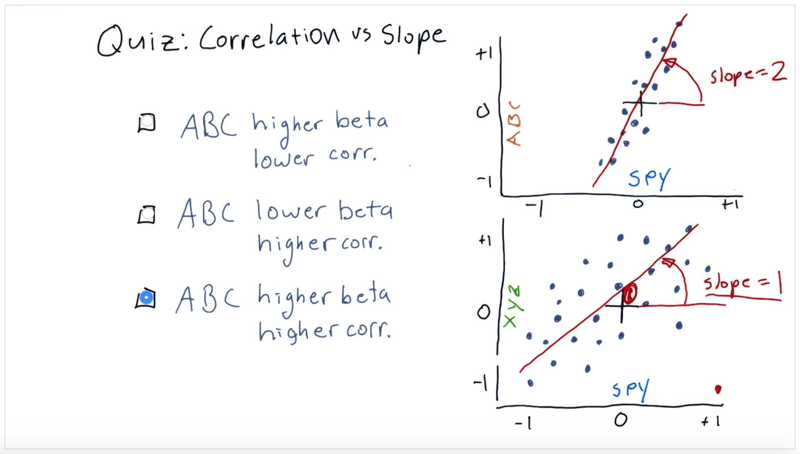

12 - Quiz: Correlation vs slope

Select the option that best compares ABC against XYZ, in terms of beta (slope of linear fit) and correlation with the market (represented by SPY).

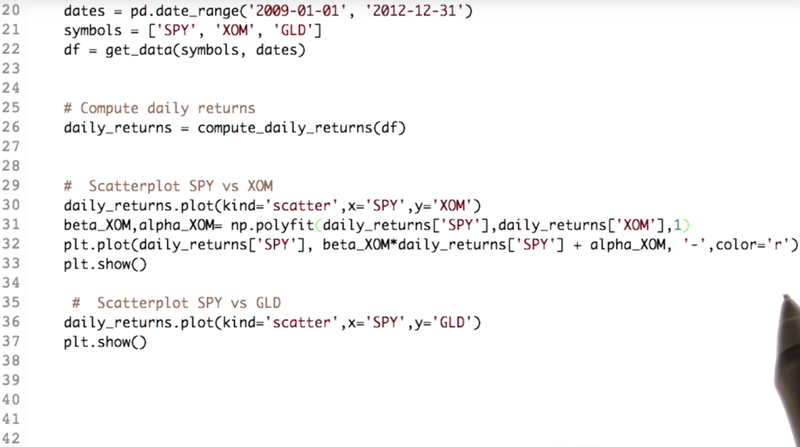

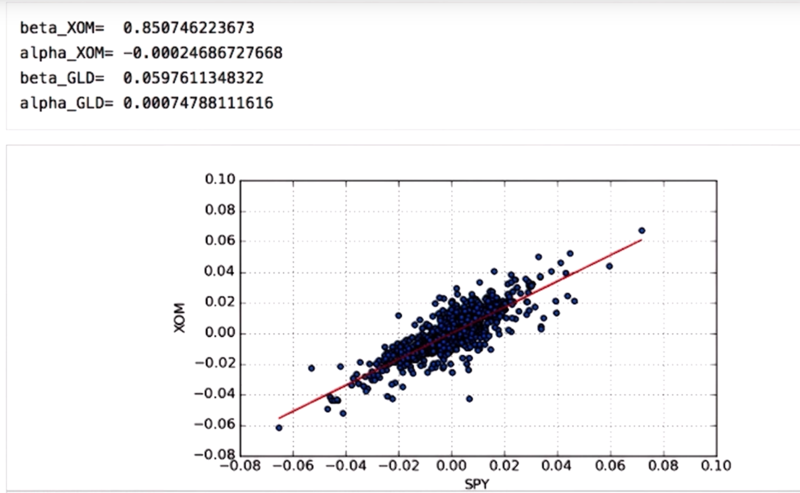

13 - Scatterplots in python

Key codes

Key codes

daily_returns.plot(kind='scattr',x='SPY', y='XOM') # scatterplot

beta_XOM,alpha_XOM=np.polyfit(daily_returns['SPY'],daily_returns['XOM'], 1)

plt.plot(daily_returns['SPY'],beta_XOM*daily_returns['SPY'] + alpha_XOM, '-',color='r')

plt.show()

- Kind parameter of the plot function of the data frame will help us plot scatterplots.

- NumPy’s

ployfit()function can fit a line to scatterplots and get alpha and beta of the regression line. the parameter “1” means the fitting is linear, y = mx + b.Here m is the coefficient and b is the intercept.

- beta values for the XOM is greater as compared to that of GLD so that XOM is more reactive to market as compared to GLD.

- the alpha values denote how well it performs with respect to SPY and Numbers indicate that GLD performed better.

One last thing is to find the correlation yet again.

daily_returns.corr(method='pearson') will output in the correlation matrix with the correlation of each column with each other column.

- high correlation means the dots fit the line closely.

Time: 00:04:45

14 - Real world use of kurtosis

- the distribution of daily returns for stocks and the market looks very similar to a Gaussian.

- but it is dangerous to assume that financial returns are normal distributions because it ignores kurtosis or the probability in the tails.

- In the early 2000s investment banks built bonds based on mortgages and assumed that the distribution of returns for these mortgages was normally distributed.

- Their model failed because of the assumption of normal distribution

Time: 00:01:06

Total Time: 00:24:11

2019-01-12 初稿